“The traditional way of doing business is slowly dying.”

Today, digitisation and its expeditious development are creating new products and services, changing consumer behaviour, and more importantly, disrupting traditional markets (Lopez, 2014). An increasing number of start-ups and incumbent companies are altering their business model to capture this digital reality, aiming to create new business opportunities and to establish longer-term relationships with consumers. In general, digitalisation is disrupting not only existing industries but at the same time creating new, novel markets that were not exploited previously. One of many is the emergence of a secondary market or so-called ‘resale market’ for trainers and collectables, which is estimated to value at $5 billion by 2025 (Financial Times, 2018).

StockX, founded and launched in 2016, is currently the world’s leading digital marketplace platform specialising in buying and selling limited-edition trainers, streetwear garments, opulence handbags and rare timepieces (StockX, 2020). Since its inception, the business secured multiple rounds of financial funding. In 2017, 6$ million worth of support was funded by co-founder Dan Gilbert, prominent investors such as Battery Ventures and GV, followed by celebrities Joe Haden and Eminem. After receiving a $44 million funding in 2018, StockX was granted the honour of the fastest-growing start-up companies in the state of Michigan. Today, the thriving business is officially valued at $1 billion after the funding round in June 2019 by promising investment ventures such as DST Global and GGC Capital (Clifford, 2019). StockX currently handles more than $120 million worth of inventories every month and attains an average of nine million monthly unique users. Over 900 employees are in action to serve the proliferate demand for trainers and collectables across the globe (Debter, 2019).

In four short years, StockX has gone from an inconspicuous bookmark on a sneaker enthusiast’s browser to be one of the most influential businesses in the industry. Besides, how did it find success? Well, thanks to digitalisation.

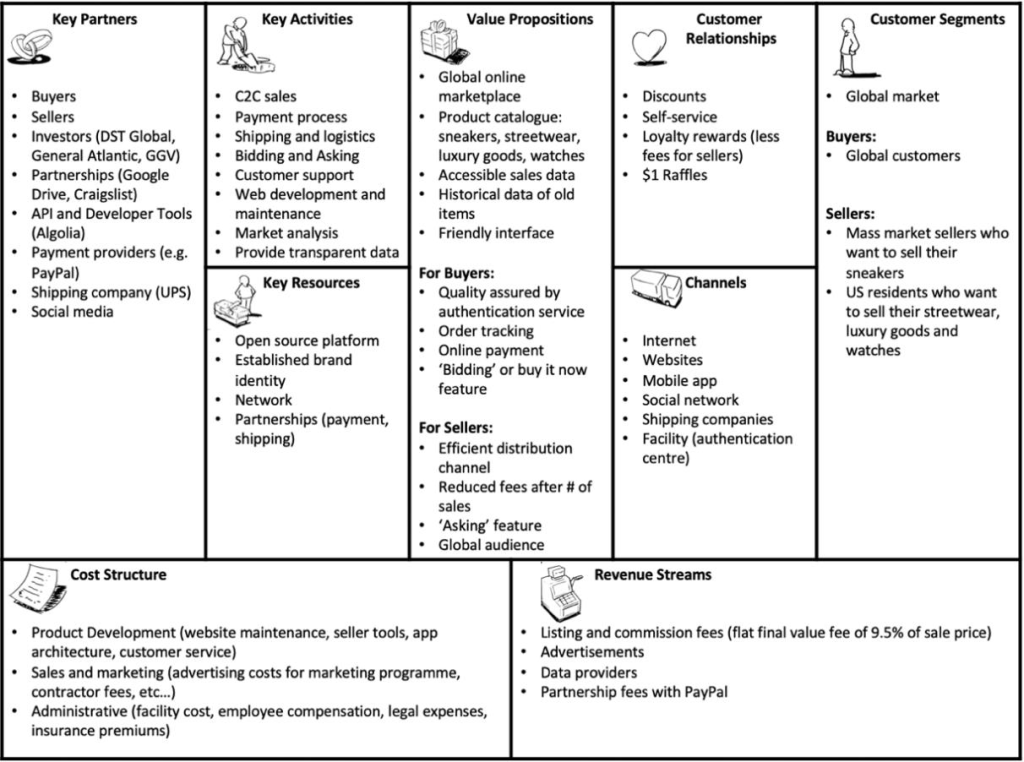

The business model

Back then, a sneaker enthusiast who wanted to offload or take possession of a particular coveted pair of trainers had limited options. Online channels for such activities were out-dated, unsafe, inaccessible and, more critically, easy for scammers to manipulate. E-commerce pioneer, eBay has also been repeatedly accused of failing to hinder fraud, protect user data and prevent the infiltration of counterfeit items (Murray, 2019). StockX was able to recognise the issues and exploit the opportunity to fill in the missing gap between buyers and sellers.

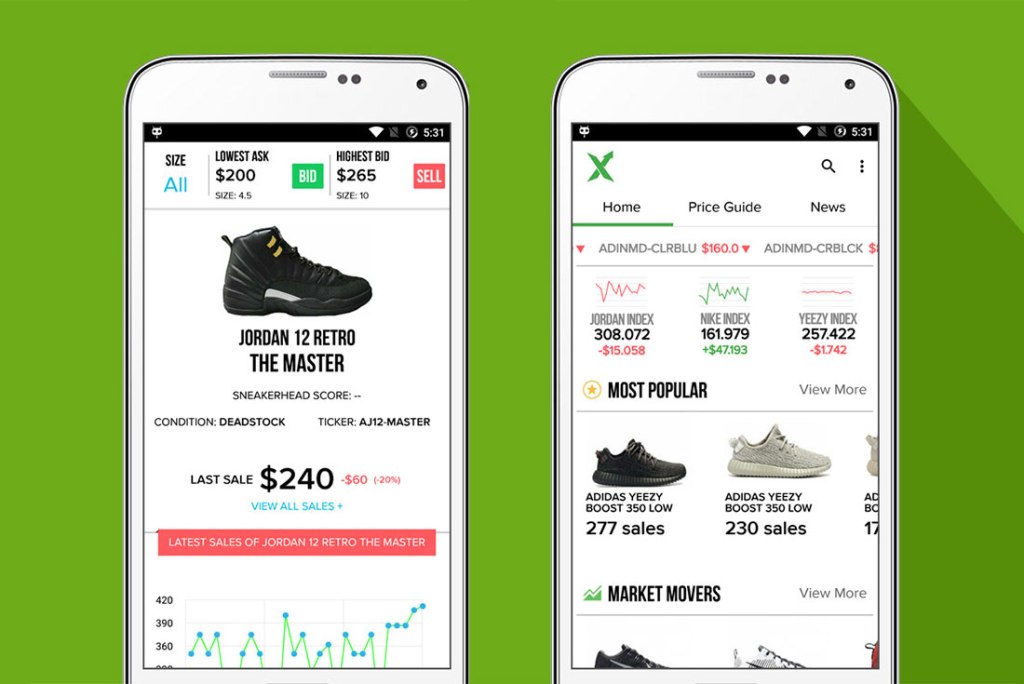

The company capitalised a peer-to-peer (P2P), or two-sided business model as a solution to the missing links. As defined by Omarini (2014), a peer-to-peer platform often refers to the chicken or the egg dilemma, which indicate interactions between the provider and supplier are necessary to function an online marketplace. StockX acts as an intermediary to facilitate interactions between buyers and sellers via a bid/ask placing system. When the two side matches, sellers will ship the item to one of StockX’s facilities, and the goods will be inspected and deciphered by a professional for its authenticity (StockX, 2020). Once the item is deemed to be genuine, it will be sent to the buyer and payment will be released to the seller. A commission fee depending on the category of the item sold will be charged as compensation for the authentication service.

StockX’s choice of the business model has enabled the company to achieve recent success by placing customers at the centre of their business. The company leveraged technologies to deliver unique value propositions in which its competitors are unable to comply with (Osterwalder & Pigneur, 2010).

One and perhaps the most significant value that had made StockX one of the most trusted sources for reselling is transparency. “The answer to what any single thing is worth is what one single person is willing to pay,” Josh Luber, the former CEO expressed (The Hundreds, 2019). While competitors such as GOAT and Grailed are similar reselling platforms, StockX’s unique digital model has enabled the platform to differentiates itself by tracking successful sales and offering a vast amount of accessible data to help depict what people are paying and selling for in the secondary market (Seppala, 2018). Thereby, they deliver a thorough representation of the current and historical market data for all trainers and collectables, enabling users to identify trends, trade ranges and price volatility within the market.

In hindsight, StockX leveraged its digital business model to create value, higher revenue, and opportunities for further expansion. The business provided a robust solution in light of the lack of accessibility, safety and transparency in the reselling industry. Its differentiation capabilities have resulted in the cannibalisation of the market share of incumbent competitors and made it practically impossible for new entrants to seize any opportunities in the monopolised market.

Word Count: 794

References

Clifford, T. (2019). StockX’s new CEO tells Jim Cramer going public is ‘certainly our objective as a company’. Retrieved 4 March 2020, from https://www.cnbc.com/2019/10/21/new-stockx-ceo-going-public-is-certainly-our-objective-as-a-company.html

Debter, L. (2019). Sneaker Resale Startup StockX Officially Joins Unicorn Club With $1 Billion Valuation. Retrieved 4 March 2020, from https://www.forbes.com/sites/laurendebter/2019/06/26/sneaker-resale-startup-stockx-unicorn-billion-dollar-valuation/#193e58e31eee

Financial Times. (2018). The footsy index: how sneakers became very big business | Financial Times. Retrieved 4 March 2020, from https://www.ft.com/content/b3ea93b2-d48d-11e4-9bfe-00144feab7de#axzz3WBgYkYUg

Lopez, J. (2014) Digital business is everyone’s business. Forbes. Retrieved 4 March 2020, from http:// onforb.es/1uBkChg

Murray, A. (2019). eBay accused of failing to stop scams as another buyer loses £1,500. The Telegraph. Retrieved 4 March 2020, from https://www.telegraph.co.uk/money/consumeraffairs/ebay-accused-failing-stop-scams-another-buyer-loses-1500/

Omarini, E. (2018). Peer-to-Peer Lending: Business Model Analysis and the Platform Dilemma. International Journal of Finance, Economics and Trade. 31-41. 10.19070/2643-038X-180005.

Osterwalder, A. & Pigneur, Y. (2010). Business Model Generation: A handbook for Visionaries, Game Changers, and Challengers. New Jersey: Wiley.

Seppala, T. (2018). Why sneakerheads are leaving eBay for Detroit startup StockX. Engadget.com. Retrieved 4 March 2020, from https://www.engadget.com/2018/02/16/stockx-day-detroit-sneaker-reselling-josh-luber/

StockX. (2019). StockX – Never Fake, Always Authentic. Retrieved Mar 4, 2020, from https://stockx.com/news/always-authentic-never-fake/

The Hundreds. (2019) How I Got Here Josh Luber Of Stockx. Retrieved 4 March 2020, from https://thehundreds.uk/content/how-i-got-here-josh-luber-of-stockx?country=GB